closed end fund liquidity risk

An open ended mutual fund has multiple advantages but they have some limitations that investors should know about. Common shares frequently trade at a discount to their NAV.

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

May introduce additional credit or interest rate risk.

. Subscribe to receive the Snapshot every month. Ratings are calculated for. It became a publicly-owned closed-end fund in 1933 becoming operational under Capital Group by 1934.

1 1 disclosure If this product is new it will not have completed its first financial reporting period. The Variant Alternative Income Fund the Fund is a continuously-offered non-diversified registered closed-end fund with limited liquidity. To review a summary of the Risk Factors related to an investment in the Apollo Diversified Real Estate Fund click here.

Investment Market and Price Risk. Leverage may also increase a funds liquidity risk as the. Closed-end Fund Snapshot.

By the end of the 1900s ICA turned into an open-end mutual fund. Fund NAV As of Sep 07 2022 Symbol. For the new share of an existing fund you may wish to view recent shareholder reports of another share of that fund by visiting another share.

Limited liquidity is provided to shareholders only through the Funds quarterly repurchase offers for no less than 5 and no more than 25 of the Funds shares outstanding at net asset. Closed-end fund shares are subject to investment risk including the possible loss of the entire principal amount that you invest. For additional information please contact your investment professional.

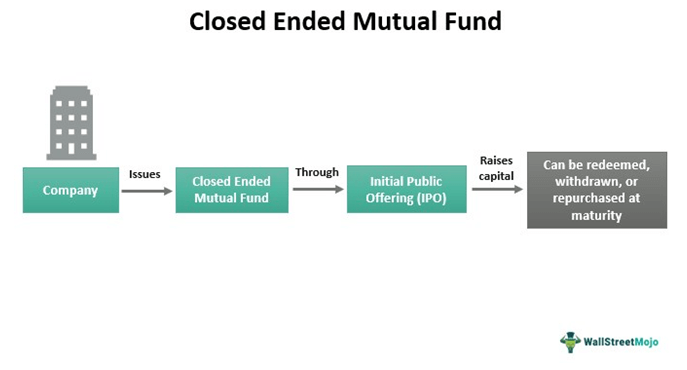

Closed-end fund shares are subject to investment risk including the possible loss of the entire principal amount that you invest. What Are Closed-End Funds. Is a closed-end interval fund.

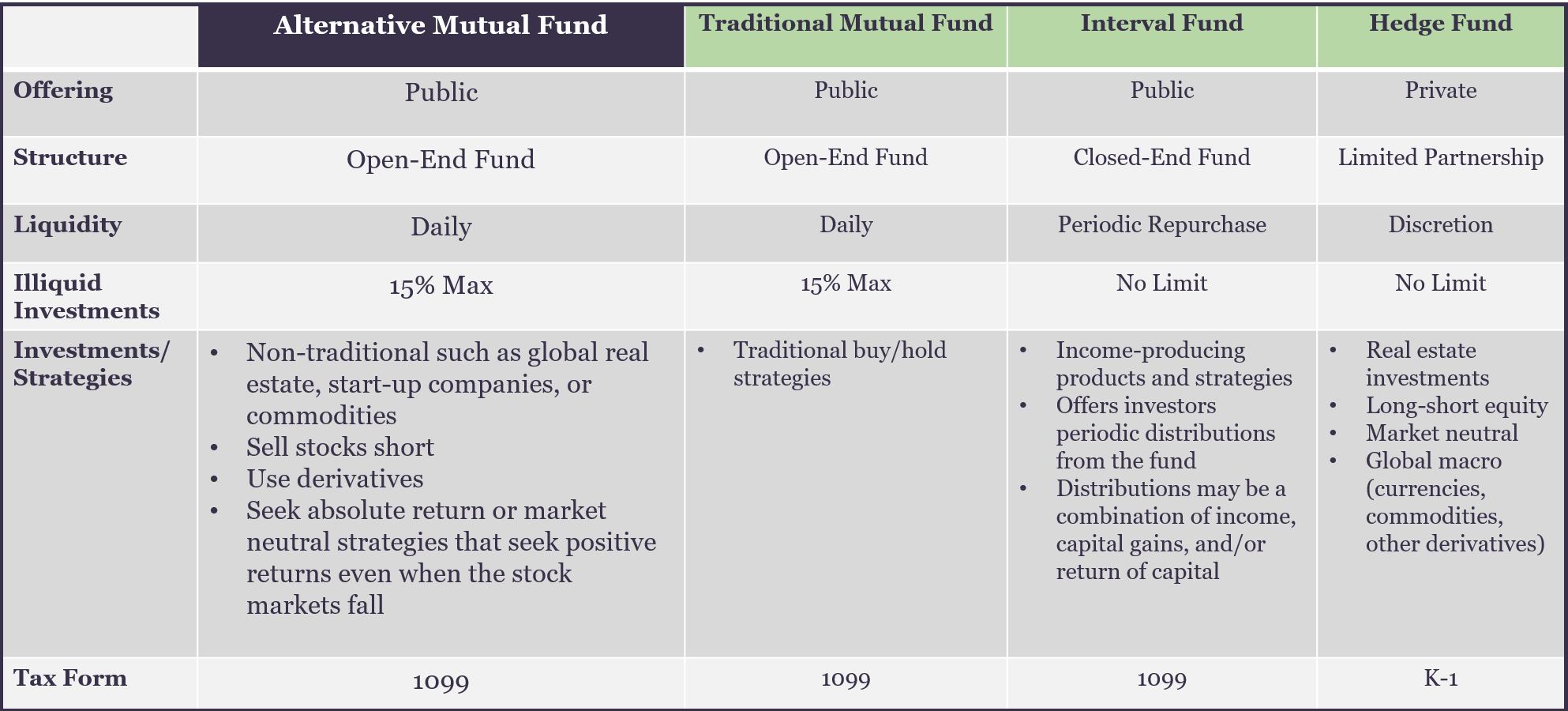

Derivatives may involve certain costs and risks such as liquidity interest rate market credit management and the risk that a position could not be closed when most advantageous. Ratings are based on a risk-adjusted return measure that accounts for variation in a funds monthly performance placing more emphasis on downward variations and rewarding consistent performanceOpen-end mutual funds and exchange-traded funds are considered a single population for comparison purposes. An investment in the Fund should only be made by investors who understand the risks involved who are able to withstand the loss of the entire amount invested.

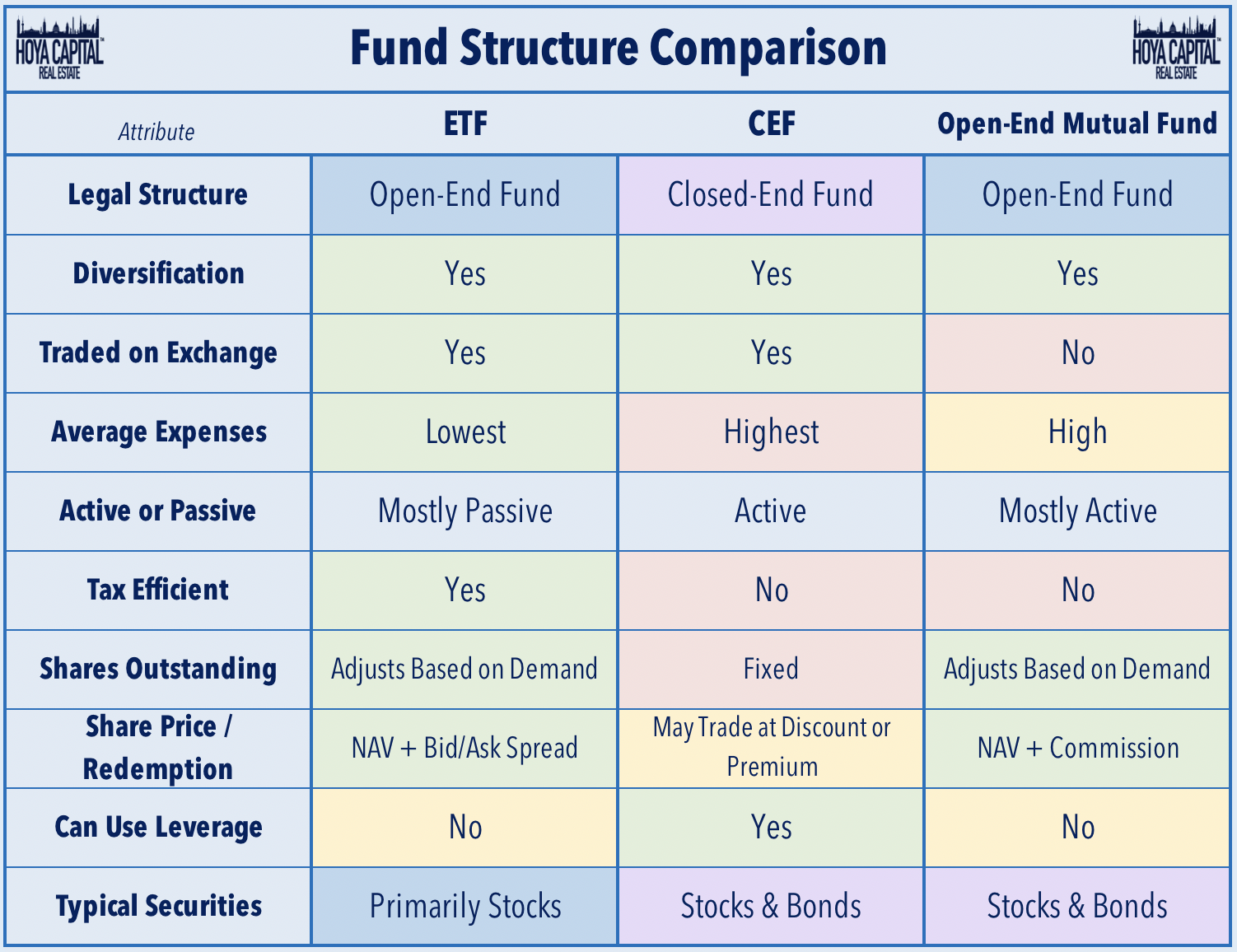

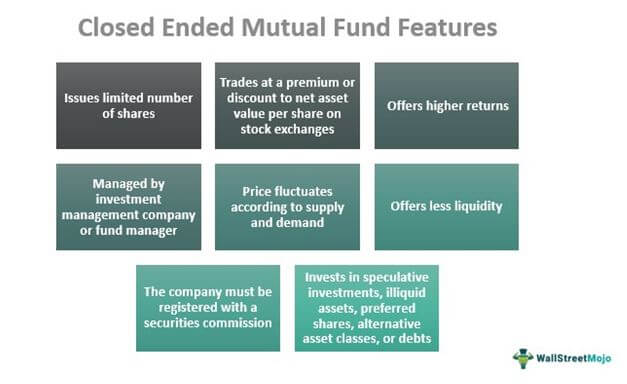

The Global Allocation Fund converted to a closed-end fund on Feb. A closed-end fund CEF is a type of mutual fund where investors pool their money and a professional money management team oversees the portfolio by selecting the underlying stocks bonds and other securities. A closed-end fund is a public indirect pooled investment vehicleYou can learn more about the different types of.

Investment Market and Price Risk. Investment policies management fees and other matters of interest to prospective investors may be found in each closed-end fund annual and semi-annual report. In lower-rated securities involve substantial risk of loss and present greater risks than investments in higher-rated securities including less liquidity and increased price sensitivity to changing interest rates and to a deteriorating economic environment.

Please check back to view future shareholder reports. For additional information please contact your investment professional. Leverage may also increase a funds liquidity risk as the.

Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. Investment policies management fees and other matters of interest to prospective investors may be found in each closed-end fund annual and semi-annual report. There is no guarantee the Fund will achieve its objective.

Closed-end funds may be leveraged and carry various risks depending upon the underlying assets owned by a fund. Common shares frequently trade at a discount to their NAV. Equity derivatives may also be subject to liquidity risk as well as the risk the derivative may be different than what would be produced through the use of another methodology or if it had.

May introduce additional credit or interest rate risk. Here is a list of the pros and cons of open.

Investing In Closed End Funds Nuveen

Alternative Mutual Fund Liquidity Spectrum Investment Comparison

What Is The Difference Between Closed And Open Ended Funds Quora

Closed Ended Mutual Fund Meaning Examples Pros Cons

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Closed Ended Mutual Fund Meaning Examples Pros Cons

A Guide To Investing In Closed End Funds Cefs

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

A Guide To Investing In Closed End Funds Cefs

Closed Ended Mutual Fund Meaning Examples Pros Cons

A Closer Look At Closed End Funds Fundx Insights

Guide To Closed End Funds Money For The Rest Of Us

A Guide To Investing In Closed End Funds Cefs

Closed End Fund Definition Examples How It Works

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)

/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)